Nominate Mark Accountants as your Tax Agent

Start HerePlacing our extensive accounting knowledge directly into your hands…

At Mark Accountants we provide helpful advice in relation to your financial affairs to achieve the best possible result for your individual situation. We do so by taking into account your overall personal circumstances, not just the limited short term outcomes. Whether you’re an employee, business owner, retiree or starting something new, we have you interests at heart and your accounting needs covered.

Some Tips for Small Business

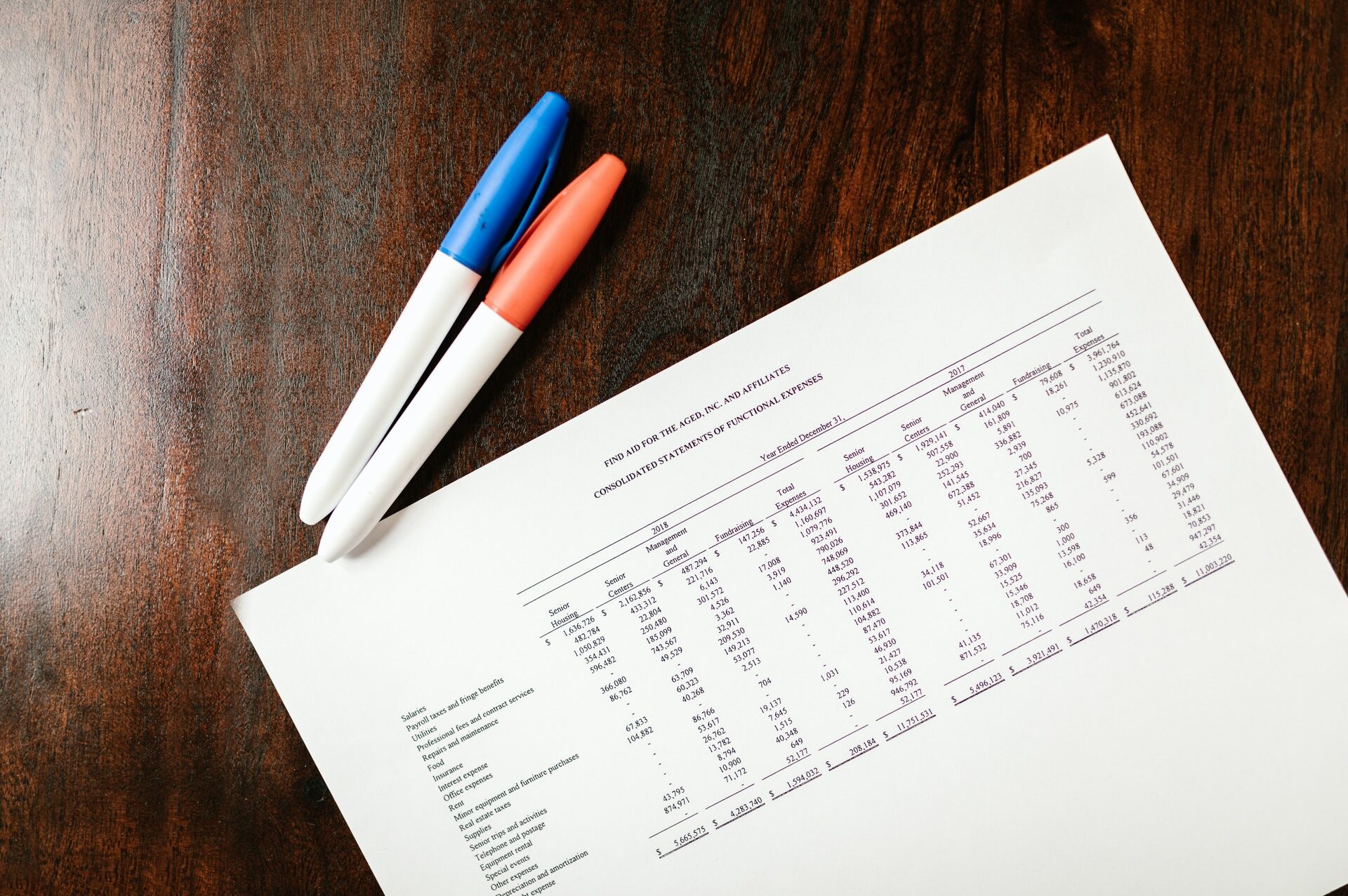

Ensure your financial statements are up to date:

These may be necessary to gain access to new loan assistance. It is also essential to assess your finances and your ability to survive on reduced revenue.

Assess the possible impact on your business:

Consider key customers, suppliers, staff and finance and how their own impacts may change your operations.

Prepare a budget based on new assumptions:

Value your figures based on a variety of possible revenue reductions to prepare for low to high-risk scenarios.

Most importantly, if you are in financial difficulty, seek advice promptly…

Join our Facebook Page! It will only take a minute.

FacebookUpcoming Key Dates

Be sure not to forget these important key dates

17th March:

St Patrick’s Day

St Patrick’s Day is an annual observance that is popular in Australia serving as a tribute to Ireland and one of its patron saints, St Patrick.

21st March:

Monthly IAS Lodgements Due

Employers are required to lodge their monthly Instalment Activity Statements for PAYG withholding to the ATO.

31st March:

FBT Year End

Whilst the due date of the return can be as late as 25 June if you use a Tax Agent, for everyone else the actual 12mth reporting period ends on 31st of March.

What we have to offer…

Our services cover all facets of accounting including tax, administration and audit of self-managed supperannuation funds, business analysis and development, new ventures and structures, estates and much more. We deal with everything from complex accounting structures to a simple Excel spreadsheet application.

We care for our clients and keep our overheads low and pass on these savings to you. We offer impartial advice – we do not accept commissions or other benefits from external advisors nor do we mark up any costs we incur on your behalf. Wherever possible we keep it simple and prefer good old-fashioned honest service. We do not rely on the bells and whistles to convey the quality of our solutions.

Now a part of the Accountplan Group

We recently joined the Accountplan Group, a financial services group of 40 years based on the Redcliffe Peninsula. This has enabled us to significantly broaden our offering at Caloundra to now include:

– full service bookkeeping services including payroll, IAS, TPAR, software set up and training

– financial planning including advice on superannuation, retirement planning, Aged Care & Centrelink entitlements

– finance broking including mortgages, business finance, equipment and vehicle finance