Scam Alerts

Find information and examples on the latest tax and super-related ATO impersonation scams.

Scam advice

Be wary of emails, phone calls and text messages claiming to be from the ATO.

If you think a phone call, SMS, voicemail, email or interaction on social media claiming to be from the ATO is not genuine, do not engage with it. You should either:

- phone the ATO on 1800 008 540

- go to Verify or report a scam to see how to spot and report a scam.

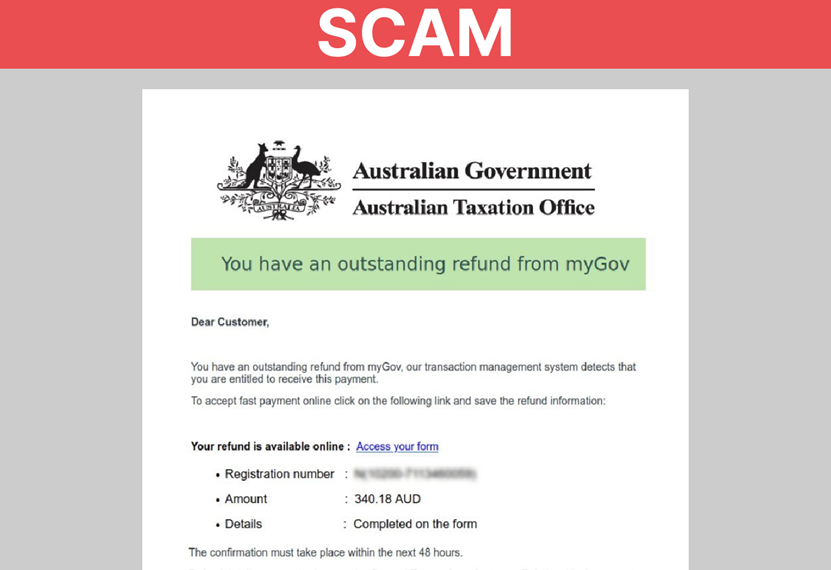

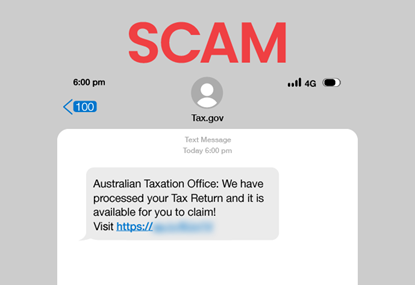

August – 2023 taxtime SMS and email scams

This tax time, the ATO are receiving an increased number of reports about several ATO impersonation SMS and email scams.

These scams encourage people to click on a link that directs them to fake myGov sign in pages designed to steal their username and password.

Scammers use many different phrases to try and trick recipients into opening these links. These include (but are not limited to):

- ‘You are due to receive an ATO Direct refund’

- ‘You have an ATO notification’

- ‘You need to update your details to allow your Tax return to be processed’

- ‘We need to verify your incoming tax deposit’

- ‘ATO Refund failed due to incorrect BSB/Account number’

- ‘Due to receive a refund, click here to receive a rebate’

The images below are examples of the format this scam can take.

Do not open any links or provide the information requested.

We won’t send you an SMS or email with a link to log on to online services. They should be accessed directly by typing ato.gov.au or my.gov.au into your browser.

While we may use SMS or email to ask you to contact us, we will never ask you to return personal information through these channels.

Report any suspicious contact claiming to be from the ATO to ReportScams@ato.gov.au.

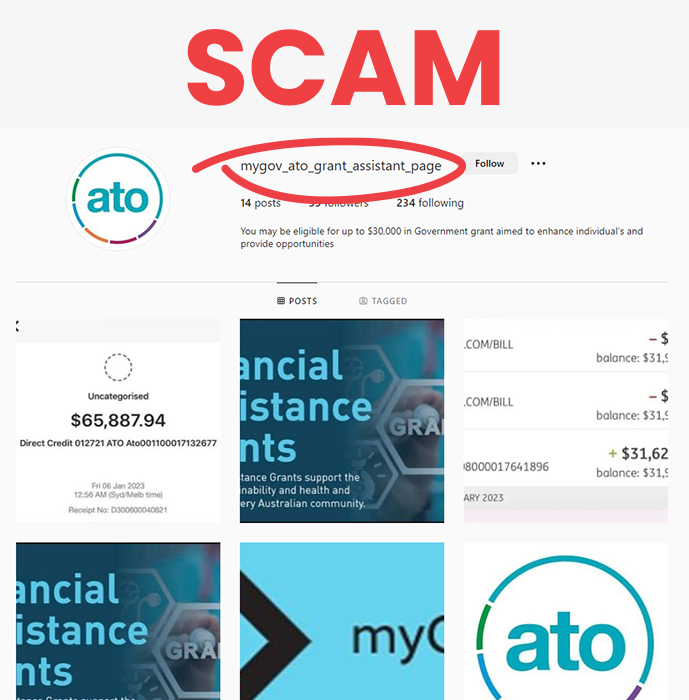

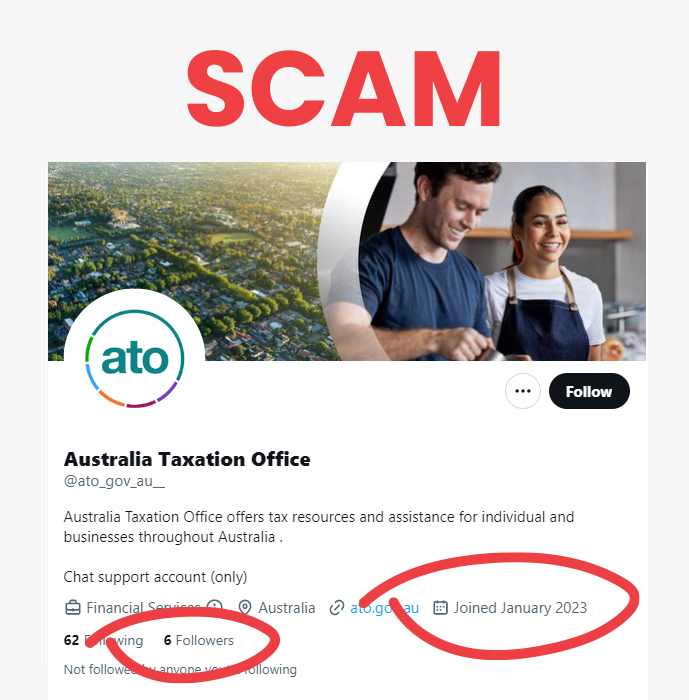

January 2023 – ATO social media impersonation accounts scam

The ATO are seeing an increase in fake social media accounts impersonating the ATO, ATO employees and senior executive staff across Facebook, Twitter, TikTok, Instagram and other platforms.

These fake accounts ask users that interact with the ATO to send them a direct message so they can help with their enquiry.

The people behind these fake accounts are trying to steal your personal information, including phone numbers, email addresses and bank account information.

The ATO’s only official accounts are on Facebook, Twitter and LinkedIn.

The best way to verify that it’s really the ATO is to:

- check how many people follow the account. The ATO’s verified Facebook and LinkedIn accounts have over 200,000 followers, and their Twitter account has over 65,000 followers

- check activity on the accounts. The ATO’s social media channels have been operating for around 10 years – if it’s a newly created account, or only has a few posts, it’s not them

- look for the grey tick next to our username (@ato_gov_au) on Twitter and the blue tick next to the ATO’s name (Australian Taxation Office) on Facebook

- make sure any email addresses provided to you end with ‘.gov.au’.

The images below show examples of what impersonation accounts might look like.

If you’re approached by an impersonation account, do not engage with them. Take a screenshot of the account, email the information to ReportEmailFraud@ato.gov.au and block the account through the social media platform’s reporting function.

Source: ATO